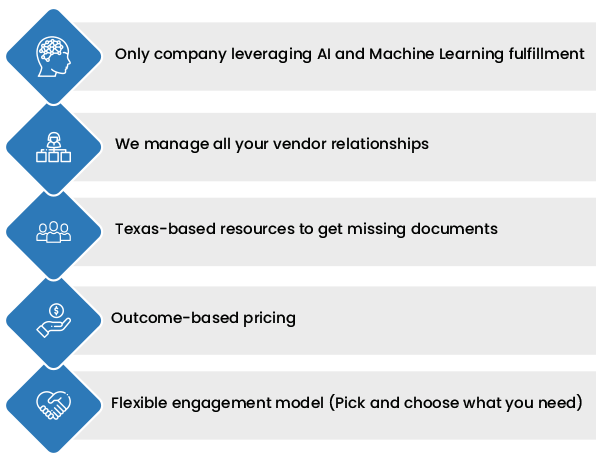

PrivoCorp is a full-service mortgage solutions provider. Our experts continually train to perform accurate audits and generate timely reports with a focus on reducing operational costs for our clients. We support Mortgage Lenders, Loan Officers, Credit Unions, and Banks with their post-closing activities. It involves diligent auditing and reporting to ensure that the file is complete and in compliance.

Our significant domain experience in this field helps in making the entire post-closing process cost saving and efficient for our clients. Our mortgage post-closing services start from the receipt of signed/funded loan documents from various origination points and includes their review for regulatory compliance.

Our clients benefit from the quick turn-around time, reduction in operational costs, rapid scalability, and improved quality.