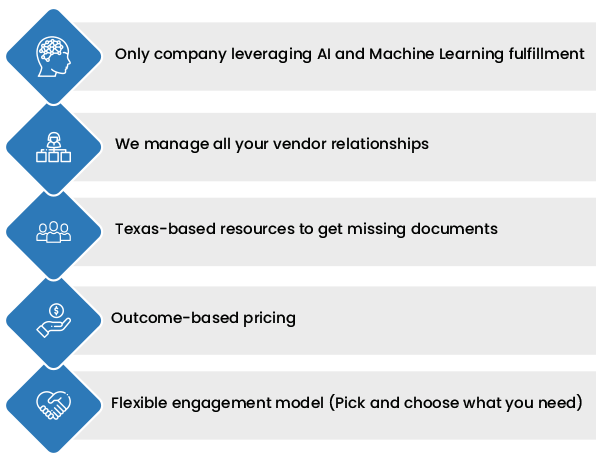

PrivoCorp is a full-service mortgage solutions provider. With our Mortgage Closing Services, we assist in all stages of the mortgage closing process, right from preparing closing documents, coordinating with settlement companies to acquire the taxes and fees and reviewing final conditions & making initial Closing Disclosures to ensuring adherence to the compliance statutes. The spectrum of these services allows our clients to rely on us for their closing support with much more confidence.

Our significant domain experience in this field helps our clients in transforming how they perform their closing processes. We are also among the only service providers who proactively manage your vendor relationships, so that our clients can focus on their core business functions. Additionally, our SSAE 18 compliance certification and other security measures ensure complete security, privacy, and confidentiality for our clients.